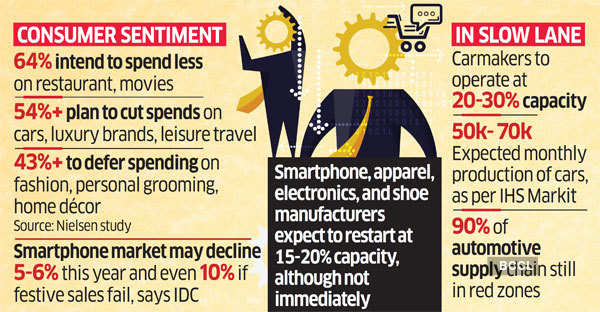

Carmakers are set to begin production this month with output at about a quarter of the usual level. Leading smartphone, electronics, apparel and shoe manufacturers expect to restart at 15-20% capacity, although not immediately. They expect a big dent in consumer demand, given salary cuts and job losses due to the lockdown that had been imposed from March 25 to curb the spread of Covid-19. Industry executives said most plants will work at low capacity at least until the festive season.

Manufacturers will have to contend with the constraints of the country being divided into red, orange and green zones, apart from containment areas that are fully sealed. The situation is fluid and zones could change depending on cases. They also have to ensure supplies from vendors can be transported to plants without a hitch and put enough distance between workers.

Most carmakers have told their supply chains to prepare for production at 20-30% of capacity, after zero production in April. Maruti Suzuki, Hyundai Motor, Honda, Mahindra & Mahindra, Tata Motors and Toyota Kirloskar Motor (TKM) will try and resume in the first half of May, whereas leading exporters Ford and Volkswagen are likely to start manufacturing in the second half of the month, according to people with knowledge of the matter.

Much will depend on opening up of markets as well, said Naveen Soni, senior vice president, sales and service, TKM, since dealerships also have to resume for any sales to happen.

Most Auto Cos to Run One Shift

“Plus the zones where our suppliers reside are also dynamic. We want to start manufacturing in May, but a lot will depend on the clearances at our supplier end and opening up of the market. There is no point producing if the buyer is not there,” he said.

Most will run one shift and have physical distancing on the shop floor. Workers have already gone into plants to start preparing for production. MG Motor have already started making a small number of vehicles at its Halol plant in Gujarat. Mahindra and Mahindra will start its engine and transmission unit at Chakan in Pune from Monday.

India is expected to make 50,000-70,000 cars in May, given the fact that first few days will go toward disinfection and rearranging the assembly floor, said Gaurav Vangaal, associate director at IHS Markit.

“The complete automotive ecosystem is in paralysis and their local administration bandwidth is already overstretched to give factory clearances,” he said. “We expect production to ramp up slowly at 10-20% in the first week, before moving to 30-50% in the next couple of weeks.”

Maruti Suzuki’s plants in Manesar in Haryana and in Gujarat will be the first to resume production and the Gurgaon factory will start later.

Logistics and supply chain challenges will need to be overcome, since over 90% of vendors are in the red zone. For instance, the Vitara Brezza’s moulding is sourced from a plant in Noida in Uttar Pradesh, while the rubber mix used in this comes from Mohali in Punjab. The mix isn’t stocked as its properties change after 20-25 days if unused.

Maruti Suzuki chairman RC Bhargava recently told ET the company will commence operations only when it can do so in a sustainable manner. Automakers have supply chain partners spread across the country and inadequate access to components will hold up production processes even if vehicle makers reopen. Besides, unless dealerships resume, stocks will continue to pile up over and above the inventory already in channel.

CONSUMER ELECTRONICS

Large MNCs such as LG, Vivo, Oppo and Realme were yet to receive the green light for resumption of production from local authorities as of Sunday evening since their plants fall in the worst-affected areas.

Most plants are expected to work at low capacity until the festive season. Several mobile phone makers export from India and some of the production may cater to that initially. Samsung also hasn’t received approval to start production and the company is yet to decide when to resume. Panasonic, Woodland and others said they would restart only when there’s demand.

Samsung, LG, Vivo and Oppo did not respond to queries.

Consumer Electronics and Appliances Manufacturers Association (CEAMA) president Kamal Nandi said production at the industry level may not go beyond 20-25% for next few months.

“Categories like AC and refrigerator will lose 30% of their annual sales due to lockdown,” said Nandi, who is also the business head at Godrej Appliances. “Demand in cities and large markets will be subdued to poor… sentiments probably continuing even during festive, and the only hope is if upcountry gets revived with good crop harvest and normal monsoon.”

SMARTPHONE

Smartphone maker Realme India CEO Madhav Sheth said once sales resume, demand will definitely be impacted due to income loss, a possible recession and the hike in goods and services tax (GST) on handsets to 18% from 12% from April, forcing all brands to raise prices.

“More consumers might postpone their plan of purchasing a smartphone for some time. We will understand the market demand once the online sales and offline sales resume and accordingly make adjustments to our production plans,” said Sheth.

IDC India research director Navkendar Singh said the smartphone market has been growing in the past two-three years as consumers upgrade.

“Consumers will hold onto their existing handsets. The market will contract by 5-6% this year and if festive sales fail, it can even be 10%,” he said. The industry expects consumers will also go for cheaper phones than flagship models.

Woodland India MD Harkirat Singh said it will reopen a few factories after some weeks and run at 10-15% capacity to prepare for the autumn-winter season, anticipating poor sales in the 600 stores it has. “We have to conserve cash too,” he said.

Puma India MD Abhishek Ganguly expects sportswear may not get impacted severely as it caters to work-from-home and fitness attire but the company has cut supplies.

“We want to keep the factory lights on since restarting production after a complete shutdown for a while might be a challenge to scale up when demand revives,” he said.

Apart from anticipated low demand, companies said it will be difficult to scale up production as they have to follow distancing norms in factories and buses.

(With inputs from Sharmistha Mukherjee)