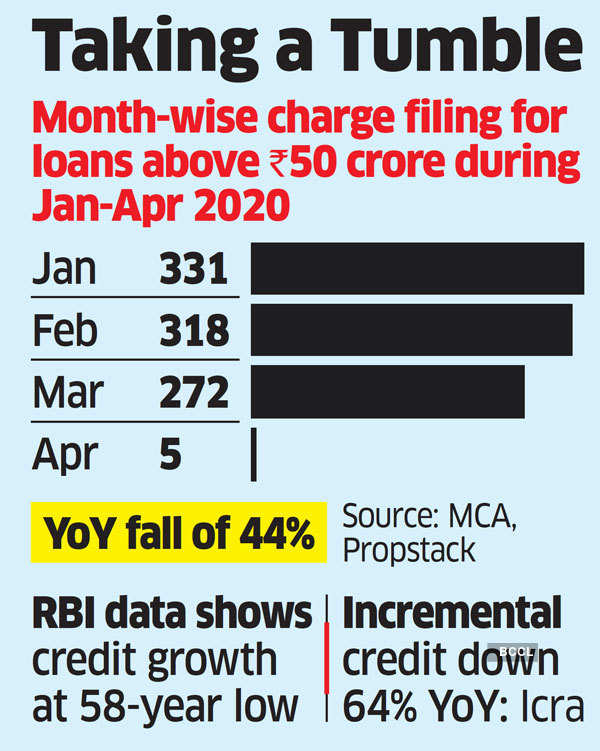

Charge filings, which indicate new loans or additional collateral towards past loans, fell 57.4% to 277 in March and April combined from 650 in January and February, according to data compiled by Propstack, a financial data intelligence provider.

The number of charge filings for loans above ₹50 crore in the January-March quarter fell 44% year-on-year. The Reserve Bank of India (RBI) data separately showed that credit grew 6.1% at the end of March, a 58-year low.

“It has been a double whammy,” a senior banking executive said on condition of anonymity. “On the one side, demand for credit is obviously low due to uncertain economic activity. The second aspect is banks have been finding it tough to complete documentation work for loans as it requires physical signing of loan documents. This has also added to the slowdown.”

While 272 charges for loans were filed in March, the number nosedived to just five till April 25.

NBFCs, State-run Cos File Charges

Non-bank lenders, housing finance companies and state-run units such as Piramal Capital, Shriram Transport Finance, PNB Housing IRFC, Maharashtra State Electricity and BSNL filed charges after bagging loans from banks.

“Based on the charge filings we track for 17 lakh companies, we observe that there is almost a 44% year-on-year decline in charge filings for loans above ₹50 crore in the period January-March 2020,” said Sandeep Reddy, co-founder, Propstack.

“Even though each charge filing is not equal to a new loan every time, the decline is significant to indicate that there is a decline in broader borrowing activity of medium and large corporates.”

Rating agency Icra said incremental credit growth declined 64% at the end of March.

Bank credit, bonds outstanding and commercial paper stood at Rs 6 lakh crore in FY20, down from Rs 16.8 lakh crore in the previous financial year.

Banks accounted for as much as ₹5.9 lakh crore of the total lending, though it was nearly half of ₹11.9 lakh crore they had lent in the previous fiscal.

The pandemic has had a severe financial impact, even as the government has tried to stave off economic collapse. According to the International Monetary Fund, the Indian economy is projected to grow at 1.9% this fiscal, sharply lower than the level of about 5% forecast earlier. Global growth is set to contract 3%, as the world stares at the worst recession since the Great Depression of 1929-33.