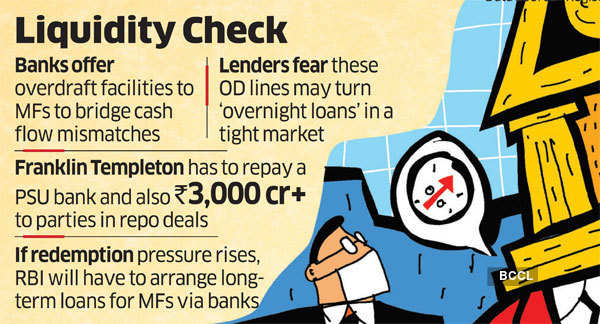

The overdraft facilities are intra-day loan lines from banks that help MFs tide over temporary liquidity mismatches in the face of redemption pressure. Larger the redemption a fund has to handle, higher the overdraft requirement in the absence of fresh inflows from investors.

“There could be a huge demand for OD (overdraft) lines. Banks will have to take a call. Given the state of the corporate bond market, banks are reluctant to let intraday loans become overnight or short-term loans. It’s possible that a fund may be unable to sell securities in an illiquid market and some of the intraday OD (lines) may turn overnight loans. Most banks won’t prefer that. And even if a bank allows it, it would like to minimise the overnight amount,” a senior banker told ET.

Banks Talking to Fund Houses

The lenders — some of whom are custodians to MFs — have been in touch with fund officials to estimate the expected mismatch between inflows and outflows on Monday.

Besides custodian banks holding securities of a fund and lending against these papers, non-custodian banks have also given large OD lines to MFs to build relationships and bag businesses such as collections and cash management. “These are largely unsecured loans. The banks sanctioned large OD lines as asset managers are regulated entities. Banks may now turn cautious, and more selective,” said another banker.

According to market sources, Franklin Templeton has to repay a loan it had taken from a large Mumbai-based public sector bank. Also, it has to pay over Rs 3,000 crore to counterparties in bond repo deals — which are repurchase agreements (between a borrower and lender) to raise short-term money. Asked about these obligations, a spokesperson for the fund house did not respond to queries from ET.

One of the MNC banks has ‘zeroised’ the OD limits as part of an internal control mechanism. “This means ODs will not be fixed based on the maximum a bank can lend to a single borrower under regulatory guidelines. The release of OD will depend on the inflows an MF expects on Monday and thereafter,” said a source.

MF schemes can borrow up to 20% in the normal course — and upto 30% subject to regulatory clearance — of the assets under management to meet redemption requirement. Many fund typically borrow towards end March when redemption pressure builds up. The credit lines from banks enable funds to avoid selling well-rated bonds at lower valuations and pay back banks as new investors put money in April. The OD demand surges at quarter ends.

Some of the bankers and fund managers ET spoke to said that RBI may step in only if they sense that there is a huge tide of redemption. “Even if RBI opens a special window, it has to be an arrangement where MFs get long tenor loans from banks. That’s because we don’t know when the market will regain confidence and secondary trades revive,” said an industry source. During the financial crises of 2008 and 2013, RBI had opened a special facility for making short-term fund available to banks for on-lending to MFs