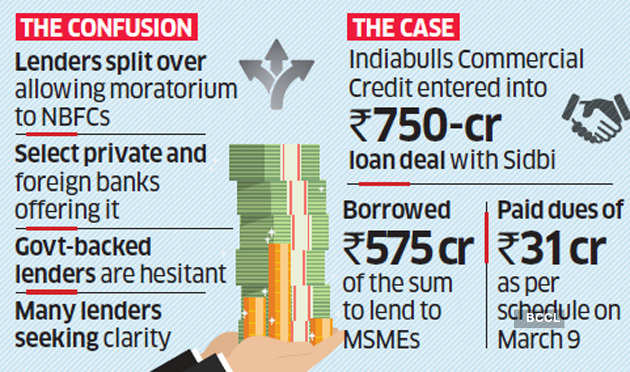

Sidbi’s query follows a Delhi High Court decision on a plea by Indiabulls Commercial Credit (ICC) seeking benefit of the moratorium that had been announced by the RBI on March 27 as part of reliefs for borrowers on account of the Covid-19 pandemic.

The HC disposed of the case as “infructuous with the clarification that the respondent (Sidbi) will not raise any further demand on the petitioner (Indiabulls Credit) towards the due installments against the petitioner till it obtains a clarification from respondent 2 (RBI).”

Sidbi Awaiting RBI Response

Sidbi had told the court that there was no clarity yet on the matter. Sidbi is yet to get any response from the central bank, according to a senior executive with direct knowledge of the matter. “There are other PSU lenders that have likely reached out to RBI for similar clarifications,” the person said.

ET reported on April 8 that NBFCs have commercial paper worth Rs 1.6 lakh crore and nonconvertible debentures (NCDs) worth Rs 87,000 crore coming up for redemption by June. Small and medium-sized NBFCs are most at risk due to the disruption caused by the Covid-19 outbreak, it said.

ICC had entered into a Rs 750-crore loan agreement with Sidbi and had borrowed Rs 575 crore of the amount. The Mumbaibased NBFC paid dues of Rs 31 crore as per the agreed payment schedule on March 9. The credit had been extended for onward lending to micro, small and medium enterprises (MSMEs). Crisil had rated ICC ‘AA’ with a negative outlook for its long-term bank loan facilities.

WAITING FOR CLARIFICATION

Senior advocate Rajiv Nayar, who appeared for Indiabulls, told the court that Sidbi had informed ICC that it was waiting for clarification from the RBI.

“Even if the demand from the next month is raised in due course, the petitioner will not be treated as a defaulter till a clarification is obtained and no such information of the petitioner being an alleged defaulter will be given to any credit rating agency,” Sidbi advocate Sanjiv Sagar told the court.

Vijayendra Pratap Singh, senior partner at law firm AZB & Partners, said the moratorium should be extended to NBFCs as they themselves have to allow the moratorium for borrowers.