The move to balance ownership and control comes as some private sector banks have sought a relaxation in licensing norms, citing the regulator’s recent decision on Kotak Mahindra Bank. The RBI didn’t respond to queries.

“The central bank has been reworking the shareholding norms to ensure parity among all players,” said one of the persons. “The new rules were in the works but delayed due to the Covid-induced lockdown, and might be issued in a few weeks.”

In January, the RBI allowed Uday Kotak, Asia’s richest banker, to hold a 26% stake in Kotak Mahindra Bank as long as the lender didn’t raise capital through a share sale. The promoter’s voting rights were restricted to 15% from April. The rules also stipulated that Uday Kotak will not be allowed to top up his stake if it falls below 26%.

The bank recently announced a fundraising plan of nearly Rs 7,500 crore that will allow Uday Kotak to bring down his stake by a percentage point. Kotak has time until September to prune his 30% holding to 26%.

Immediately after the Kotak decision, IndusInd Bank’s promoters, the Hinduja brothers, wrote to the RBI early March, seeking nod to raise their stake to 26%, citing the relaxation granted to Kotak.

Bandhan Bank

The bank has not received any official communication yet from the regulator on this subject.

In October 2018, Bandhan Bank was barred from opening branches and the salary of chief executive officer Chandra Shekhar Ghosh was frozen as the promoter entity hadn’t pruned its stake to the required level. Despite a merger with Gruh Finance aimed at meeting the norm, Bandhan Financial Holdings still owns more than 60%. The lender hasn’t announced any fundraising plans to dilute the promoter stake. Restrictions on the bank and its chief were, however, recently lifted.

“Banks are presently on different sets of licensing norms and after the relaxation given to a few, it is imperative that RBI creates one set of norms to be followed by all,” said an official aware of the process. “There is one set of rules that Kotak is following, while Bandhan promoters look in no hurry to comply with their licensing rules. In a bailout move, State Bank has been allowed to hold more than 48% in Yes Bank, while Prem Watsa owns a majority stake in Catholic Syrian Bank. All of this sends confusing signals to the industry on licensing norms, and that needs to be fixed.”

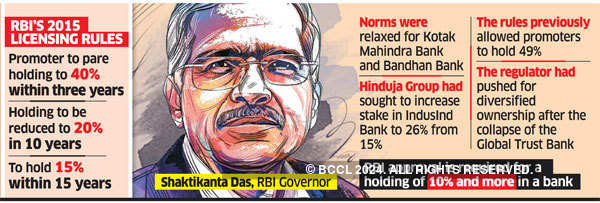

RBI’s 2015 licensing rules require the promoter of a private bank to reduce the holding to 40% within three years, 20% within 10 years and 15% within 15 years of operations starting.

The rules previously allowed promoters to hold 49% but the regulator pushed for diversified ownership after the collapse of the Global Trust Bank. RBI approval is required for a holding of 10% and more in a bank.